How to calculate capital gains

Calculation of capital gains can be a complex and challenging mission relying on the nature and the number of transactions undertaken by the assessee in a financial year. It is always suggested to take the advice from an professional like a chartered accountant for the same. However, Assessee can also calculate by himself by going the proper step by step methodology, then he can compute his own capital gains. Here’s how to do it yourself.

Capital gains arise whenever a capital asset is transferred (by way of sale or otherwise) by the assessee. They are further classified into two: short term capital gains (STCG) and long term capital gains (LTCG) on the basis of asset’s holding period

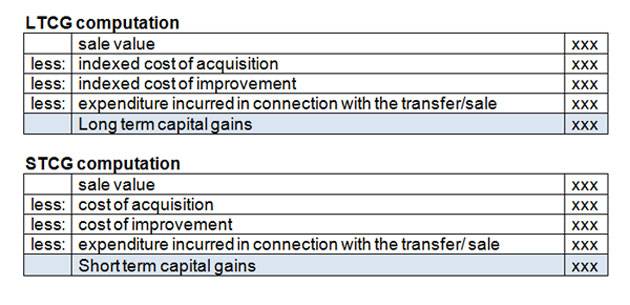

A standard format has been provided under the Income tax Act, 1961 for calculating LTCG and STCG (see below):

If assessee try and understand the meaning of each term in the above format, he can conveniently compute his own capital gains.

UNDERSTANDING EACH TERM

Sale Consideration : It is the value received or receivable on the sale of capital asset . In the case of a property, if actual sale price is less than the stamp duty value (SDV) of the property, then the SDV is taken as the sale value. In the case of equity shares or mutual fund the Total selling price,other than the brokerage charges and securities transaction tax or STT is considered as the sale consideration.

Cost of acquisition: It is the purchase price of the asset which has been sold. The brokerage charges paid to buy the asset have to be included in the purchase price.

Whenever the sold asset was acquired by way of gift, then the cost of acquisition will be the same as the cost of acquisition in the hands of the person who gifted the said asset. Make sure that the holding period starts from the date when the said asset was purchased by the by the person who gifted it .

Cost of improvement: It is the amount added by way of major repairs,reconsturctions or modifications of the asset. Howerver whitewash, Paints will not be counted as a cost of improvement, whereas money spent on major modifications, like constructing a floor or an additional room, will qualify as cost of improvement.

Also, the money paid by the landlord to the tenant to get the house vacated can be taken as cost of improvement.

Expenditure in connection with transfer/sale: It includes brokerage charges, registry charges or other expenses made on the asset sale. In equity shares and units of equity oriented mutual funds where STT is charged on sale transaction, the STT charges can’t be deducted while computing capital gains.

Indexation: The concept of indexation is applicable only in case of Long term capital gain . Indexation is incorporate just the time value of money for beat the inflation factor while computing the gains so as to make the computation just and fair. Indexation is done by using Cost Inflation Index (CII). The rules for applying indexation on capital gains computed in FY 1718 have changed, however, while computing indexed capital gains for FY1617, the rules provided in below mentioned link would continue to apply.

For FY 17-18, the indexation procedure remains same, however, the Cost Inflation index table has changed because the base year has been shifted from 1.4.1981 to 1.4.2001.

Holding period: It is calculated as the number of days or months for which the asset is/was held by the assessee.

the date on which the asset is transferred is not to be included when computing the holding period. This time period classifies the nature of gains as short term or long term.

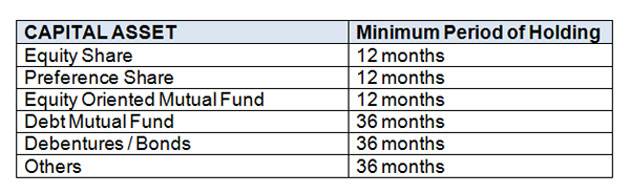

The table below shows the minimum period of holding which would classify a capital asset as long term(applicable for FY 1617).

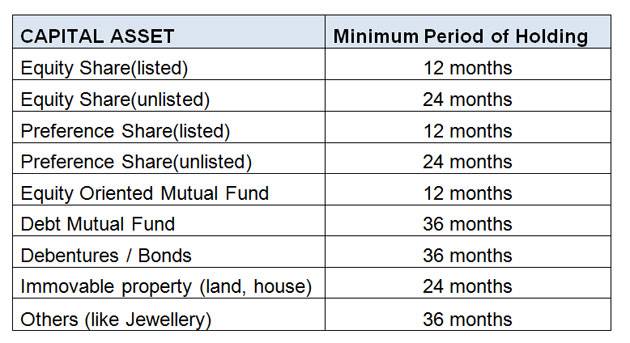

However, the period of holding for some asset classes would change for when calculating capital gains for FY 17-18

Points to be note down :-

In case the Sale Consideration of the capital asset is less than the price at which it was purchased , then the resultant amount would be termed other as loss under the head capital gains,depending on its holding period, it is treated as long term capital loss or short term capital loss .

At last , add all LTCG arising from transfer of different capital assets and do the same for all STCG, LTCL and STCL too.Please note that the following items are not considered as capital assets and any profit or loss on their sale is not subject to capital gains:

* Stock in hand for sale or raw materials for production kept for the purpose of business or profession.

* Items kept for personal use like television, air conditioner, furniture, etc.

* Rural agricultural land.

* Gold deposit bonds notified by the government.

* Silver utensils, only if they are kept as a personal use item, like thalis, katoris, etc.