Low inflation means you pay more capital gains tax

Prices rising at a slower rate should be good news. But not if you have earned long-term capital gains tax. The consistent decline in inflation in the past 3-4 years means that long-term capital gains hardly can be escape tax through indexation.

Indexation takes into account the inflation during the holding period and accordingly adjusts the purchase price of certain assets. This upward revision in purchase price reduces the capital gains and brings down the tax liability.

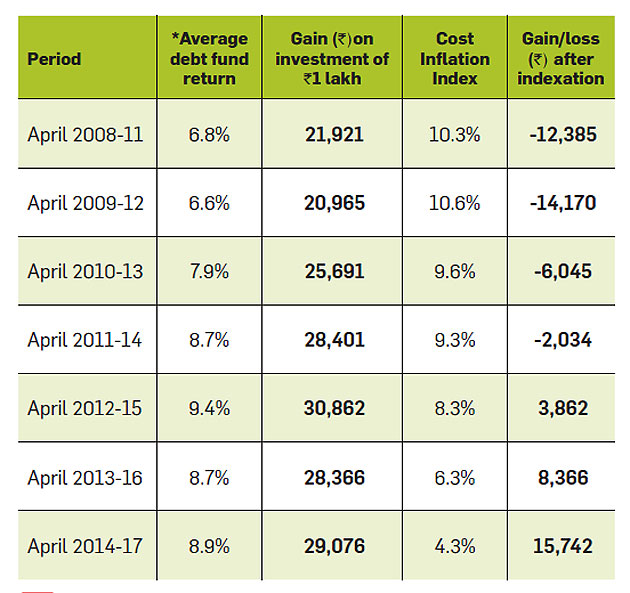

Between 2008 and 2012, consumer inflation was raging in double digits, which meant that debt fund investors were earning tax-free gains.

Someone who invested Rs 1 lakh in a debt fund on 1 April 2011 would have earned Rs 28,400 over the next three years. However, with the cost inflation index (CII) shooting up 9.3% during the same period, the investor would have booked a notional loss of Rs 2,034 on the investment. This loss could be set-off against other long-term capital gains. What’s more, the unadjusted loss could be carried forward for up to eight financial years.

Low inflation, lower benefits

Declining inflation has ended this party. The government-notified CII figure for the current year (2017-18) stands at 272. This puts the rise in inflation over past one year at 3%. The rise in the CII has consistently slowed down since 2013-14 when it had shot up 10%. Accordingly, the incidence of capital gains tax has steadily risen. An investment of Rs 1 lakh made in April 2012 would have earned around Rs 30,000 for the investor over the next three years. But inflation was lower at 6.3% during this period, so the investor was saddled with a small taxable amount of Rs 3,862 after indexation.

This year, investors would have to shell out even higher tax. Short-term bond funds clocked an average 8.9% return as on 1 April, over a three-year period, but inflation for the corresponding period was 4.3%. This translates into an effective capital gains tax of 10.4%.

With inflation expected to remain muted in the near term, higher capital gains tax is likely to continue. “Due to the higher inflation few years ago, investors got used to zero tax incidence on capital gains. They are now likely to face a higher tax burden on their

investments,” “All instruments where indexation benefit is available will see their post tax return come down,”

Keeping record of transactions

It is easy for mutual fund investors to calculate their tax liability. Nearly all fund houses allow investors to download year wise statements of their capital gains. But records of other transactions, such as purchase of gold jewelry, will have to be maintained by the investor himself.

Most of the mutual fund investors also do not claim the tax benefits available on capital losses because it complicates their tax return. Unfortunately, tax rules do not allow an assessee to revise his tax return after the assessment is over. So, if someone did not mention a capital loss booked a few years ago, it is gone forever.

What investors should do

Experts maintain that investors still stand to benefit from these instruments, given that indexation helps bring down the tax liability.

“Investors are still better off with the indexation benefits they enjoy under the new debt fund taxation regime,” says Nagpal.

Without indexation, the tax incidence would be much higher. “Those who have invested in bond funds over the past 6-12 months should stay invested until the three-year holding period is complete. Else the gains will be taxed at the rate corresponding to their income tax slab,”

The returns are little bit low than those of short-term debt funds, but they are tax-free after one year. This means the investor does not have to stay invested for three years just to ensure a lower tax liability.

Change in rules

Some of the rules for capital gains have changed in recent years. Three years ago, the minimum holding period for debt and debt oriented mutual funds to be classified as long-term assets was extended from one year to three years. On the other hand, the minimum holding period for real estate has been reduced from three years to two years. So, keep an eye on the calendar when you invest in a capital asset.