Step by Step Guide to file the Form GST TRAN-1

1. After login, select Services, then select Returns and click on Transition Forms. (Services >Returns > Transition Forms) GST TRAN-1

2. The tabs of transition forms TRAN 1/TRAN 2/TRAN 3 are visible in the top hand. By default tiles of Form TRAN-1 will be visible.

3. Select the option ‘Yes’ or ‘No’ for ‘Whether all the returns required under relevant earlier laws for the period of six months immediately preceding the appointed date have been furnished’. Relevant tables will be visible in Form GST TRAN I, depending upon the option selected.

4. Declare/ Fill in the required details in each tile and press “Save– button at the bottom. The system will validate the entries and if there is any validation error, system will show status as processed with error. On clicking the edit button against that entry the nature of validation error can be seen on the top portion of screen.

5. Declare the details of the amount of tax credit carried forward in the returns filed under relevant other laws and admissible as GST credits, by clicking on the tile 5(a),5(b), 5(c).

a. The Registration Numbers under earlier laws mentioned in the above table or in any other table of TRAN 1 need to be the same as declared by the taxpayer in their enrollment/registration form otherwise system will throw validation error.

b. If the taxpayer has failed to furnish any registration number of earlier laws, he may use the non-core registration amendment facility to declare it in the registration details and subsequently file GST TRAN-1.

6. Declare details of capitals goods for which credit has not been availed under relevant earlier laws and are admissible under GST by clicking on the tile 6(a), 6(b).

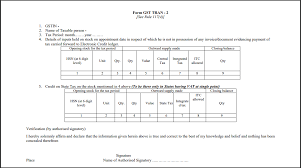

7. Declare details of the inputs held in stock by clicking on the the 7(a), 7(b), 7(d) and furnishing the required information to avail the credit of eligible taxes and duties paid under earlier laws and for which credit is allowable under GST regime.

8. Declare the details of tax paid under earlier laws and credit admissible on inputs (goods) and services received within 30 days (60 days in ease of extension) of appointed day in table 7(c).

9. Declare details of transfer distribution of Central Tax credit claimed in table 5(a) an account of CENVAT credit carried forward in last return for registered person having centralized registration under service tax by clicking on the tile 8.

a. In tile 8, you are allowed to enter only GSTIN of receivers that have same PAN as the taxpayer furnishing details in GST TRAN-1. The transferred central tax ITC will be posted to the ITC ledger of the recipients.

10. Declare details of goods sent to job-worker and held in his stork on behalf of principal (by both job-worker and the principal) by clicking on the tile 9(a) & 9(b).

11. Declaration of details (by both the agents and the principals) of goods held in stock by agents on behalf of the principal and its admissible lTC to agents by clicking on the tile 10(a) & 10(b).

12. Declare details of transition credit availed on transaction subject to both service tax and VAT, On which tax has been paid under earlier laws and are also taxable under GST. by clicking on the tile 11.

13. Declare details of goods sent on approval basis, six months prior to the appointed day by clicking on the tile 12.

14. Click on Submit button to freeze the GST TRAN-1.

a. Please note that after submit, no modification is possible. Hence ensure that details are filed correctly before clicking on Submit button.

15. On successful Submit of TRAN-1, the transition credit claimed in the details provided would be posted to Electronic Credit ledger. However, it can he utilized only after filing of GST TRAN-1 by signing it.

16. Click on File button using DSC or EVC.

17. Message for successful filing will appear and Acknowledgement will be generated.

18. The ITC posted in Electronic Credit Ledger, post successful filing, can he used to offset liabilities GSTR3B (July 2017) or any other subsequent returns.