Why you need TDS certificates when Form 26AS provides all information

One can gather all information related to TDS in Form 26AS which is sufficient to file one’s return. This might make you doubt the importance of TDS certificates but the rationale behind introducing Form 26AS is to enable the taxpayer to cross check the details mentioned in his/her TDS certificates with those mentioned in Form 26AS and create transparency. TDS certificates are important because :

The TDS certificate shows how much income you have earned from particular employer/ deductor.

In case TDS is not reflecting in the Form 26AS then you would need the certificate to prove that tax was actually deducted. Sometimes it happen that the employer / deductor did not deposit the TDS or deposit it against wrong PAN.

Sometimes it happen that income and TDS belonging to some other person has been reflected wrongly in your 26AS. You can not claim the TDS benefit belonging to someone else and wrongly reflected in your 26AS. or you can not pay income tax on the income of some other person wrongly shown in your 26AS.

In case of salaried persons, Form 26AS in itself is not sufficient to file the return since it does not show the breakup of your income and details of deductions claimed under section 80C to 80U which are available in TDS certificate Form 16 Part B issued by employer

In case your return gets picked up for scrutiny then you are likely to need your TDS certificates to show to the IT department

TDS certificates and the Form 26AS are a cross check for each other-in case there is a mismatch you can try to get the relevant document corrected. Without the TDS certificate you would not get to know if there was a mismatch.

TDS certificates downloaded from TRACES has to be issued

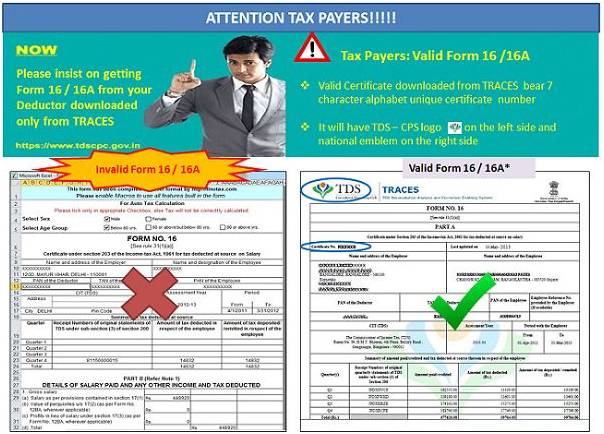

You should ensure that TDS certificates (Form 16/16A) issued to you are downloaded only from TRACES (TDS Reconciliation Analysis and Correction Enabling System of the Income tax department). Sailent features of TDS Certificates downloaded from TRACES are

TDS Certificates downloaded from TRACES are in a specific format.

A form downloaded from TRACES would bear a 7 character alphabet unique certificate number and it will also have a TDS- CPS logo on the left side and a national national emblem on the right side at the top.

In case of Form No 16 (Salary TDS Certificate) PART A regarding the Tax deduction and deposit with govt is downloaded from Traces and PART B giving details of your salary is issued manually by your Employer

This certificate would provide the details of the income paid to you and also the tax deducted from that income by the payer and whether the same has been deposited by him with the government.

See below for a sample of how a valid TDS certificate in Form 16 or Form 16A should look.

TDS certificate has to be signed

TDS Certificates should be signed by the person issuing these certificate. These can be signed manually or by Digital signatures. In case of digitally signed certificates check that the signature is verified i.e. has a check mark across it. An unverified signature will bear a question mark over the signature instead of the check mark.

Check following details on TDS Certificate

Your name

You Correct PAN,

Deductor’s TAN,

Amount paid to you check with your bank statement (Amount received after TDS should tally with cheque received/ bank entry )

TDS amount deducted

Cross check TDS certificate figures with Form 26AS

In case certain taxes claimed as deducted or paid by you in your return are not reflected in the Form 26AS then you may get a notice from the tax department when it processes your return .

Form 26AS provides details such as name of the deductee, PAN of deductee, details of deductor, the TDS amount, the amount of TDS deposited with the Government by the deductor etc.

The user can download the statement from the income tax e-filing website .The link to download Form 26AS from TRACES can be found after logging into your account on the income tax e-filing site www.Incometaxindiaefiling.gov.in

You can verify whether your TDS -as shown in the TDS certificate received from the deductor –has actually been received by the government or not by comparing with the Form 26AS. It is the duty of a taxpayer to verify whether the deductor has deducted tax on each transaction on which it was supposed to be deducted. He must also check that the TDS mentioned in form 16/16A is reflecting in Form 26AS.

In case TDS shown in your TDS certificate is not reflecting in your Form 26AS it would imply that although the deductor has deducted the tax on your behalf but the TDS has not been deposited / has not reached the income tax department. In case of any discrepancy between the TDS certificates and Form 26AS inform your deductor and ask for the reasons for this discrepancy and get it corrected. A possible reason behind the mismatch can be because your PAN has been incorrectly entered in the records of the deductor. In case the deductor has not deducted the tax on your behalf, then it is your responsibility to remind the deductor to deduct tax on your behalf and deposit the same with government.

Following details would also be available in your Form 26AS in case applicable:

Details of tax deducted on your behalf by deductors

Details of tax collected on your behalf by collectors

Details of tax deducted on sale of Immovable Property

Refund received during the financial year by you

Any advance/regular/ self assessment tax that you pay.

Details of your transactions in Mutual Fund, Shares and Bonds, etc.

A person deducting tax on account of buying an immovable property needs to submit TDS certificate to the seller in Form 16B. Link to download Form 16B (Tutorial) http://contents.tdscpc.gov.in/en/download-from16b-etutorial.html

Time to receive TDS Certificates

TDS certificate in Form no 16A has to be issued Quarterly by the deductor within 15 days from the date of filing of TDS return . Form No 16 (Salary ) has to be issued by 31st may of the end of the financial year check Download TDS Certificates from Traces within due Date